tax benefits of retiring in nevada

At 83 Total tax burden in Nevada is 43rd highest in the US. Nevada has no income tax.

States That Don T Tax Retirement Income Personal Capital

How We Determined the Best Places to Retire in Nevada.

. A retirement in Nevada makes a lot of financial sense for many individuals. Youll Likely Pay Less in Taxes. Offer helpful instructions and related details about Advantages Of Retiring In Nevada - make it easier for users to find business information than ever.

In the top 10 of states according to data from NOAA. The state ranked 28th highest for property tax collections in 2020. Your district is 200 and the in 2012- 2013 fiscal year the property tax rate was set at 32782.

California will tax you at 8 as of 2021 on income over 46394. They are not taxed. The Silver State wont tax your pension incomeor any of your other income for that matter because it doesn.

We also checked the number of recreation centers and retirement communities per 1000 residents. No Franchise Tax. Retirees in Nevada are always winners when it comes to state income taxes.

How Soon Can You Retire. Those savings add up forever or as long as you remain a resident of Nevada. 323 on all income but Social Security benefits arent taxed.

If you have a 500000 portfolio get this must-read guide by Fisher Investments. Even if you are required to source part of your income from a state that has an income tax you may still benefit from a significant reduction to your overall tax burden. Locate the property tax rate for your particular district.

According to Sperlings Best Places the cost of living index in Nevada is 102. Rhode Island has no military retirement-specific tax breaks on the books though taxpayers over 65 are able to exempt a portion of their income if overall income levels fall below a given threshold -- 87200 for individual filers in 2022. Nominal Annual Fees.

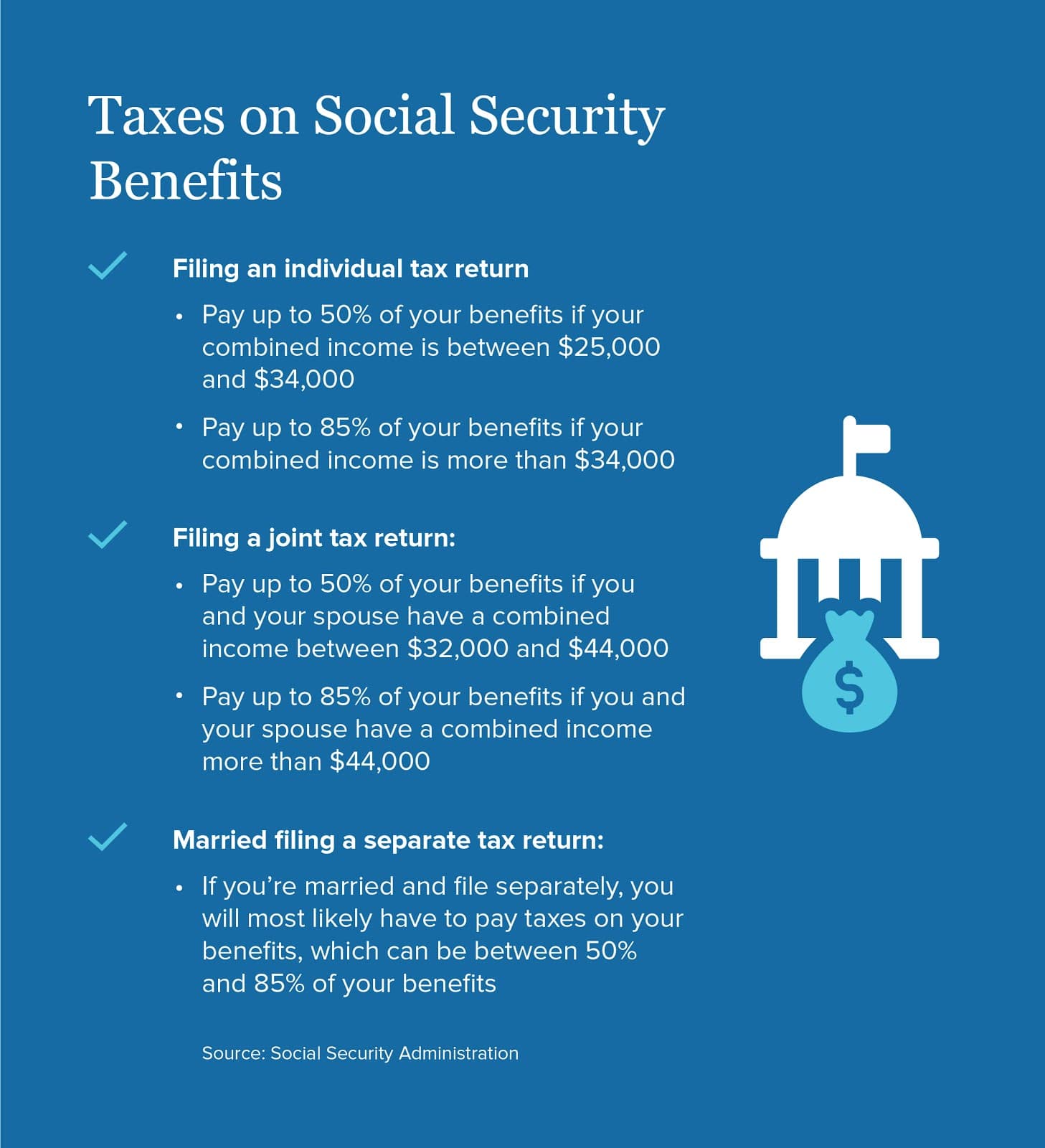

29 on income over 440600 for single filers and married filers of joint returns 4 5. While California exempts Social Security retirement benefits from taxation all other forms of retirement income are subject to the states income tax rates which range from 1 to 133. Nevada is a low-tax paradise.

State sales tax is 685 but localities can increase that to 81. Residency is single most important factor in gaining nevadas tax advantages. Social Security and Retirement Exemptions.

Retirement in nevada or any state is a big deal especially when it entails relocation from another. People who live in Nevada typically pay more for groceries healthcare and transportation than the average consumer. And the number of places where benefits arent taxed has been.

No Personal Income Tax. Nevada is one of only a few states that does not impose an income tax and that includes income from Social Security and retirement accounts. 1 day agoThe measure would not address USPHS or NOAA income nor would it affect survivor benefits.

No Taxes on Corporate Shares. Considering the national average is 100 retirement here is going to cost more than some other states. However the amount of property taxes is not exceptionally high by most standards.

No corporate income tax. Top Reasons to Incorporate in Nevada. No Corporate Income Tax.

The state of Nevada does assess taxes on property. Nevada has far more sunny days and lower humidity to enjoy them than most states. The good news is this represents the majority of states in the US.

Top Ramen Recipes Top Ramen 48 Pack Christopher Wren Apartments Gahanna. The states that dont tax pension plans extend those same benefits to retirees with 401k plans. Marginal Income Tax Rates.

Thanks to all of the tax revenue flowing to the state from the casinos and tourism Nevada currently offers residents of the state a low overall tax burden compared to most. One such factor is the percentage of seniors in each city to ensure you wont be without peers in retirement. No personal income tax.

Taking advantage of Nevada tax advantages lets you keep more of your money in your pocket. Ad Read this guide to learn ways to avoid running out of money in retirement. Nevada offers an abundance of tax advantages for relocating home and business owners alike including.

The property taxes assessed on an average-priced home in Nevada is 1423 per year according to Kiplinger which ranked Nevada No. Nevada corporations may purchase hold sell or transfer shares of its own stock. To find the best places to retire in Nevada we looked at a few important factors.

No gross receipts tax. Nevada Retirement Tax Friendliness Smartasset. Military retirement pay is partially taxed in.

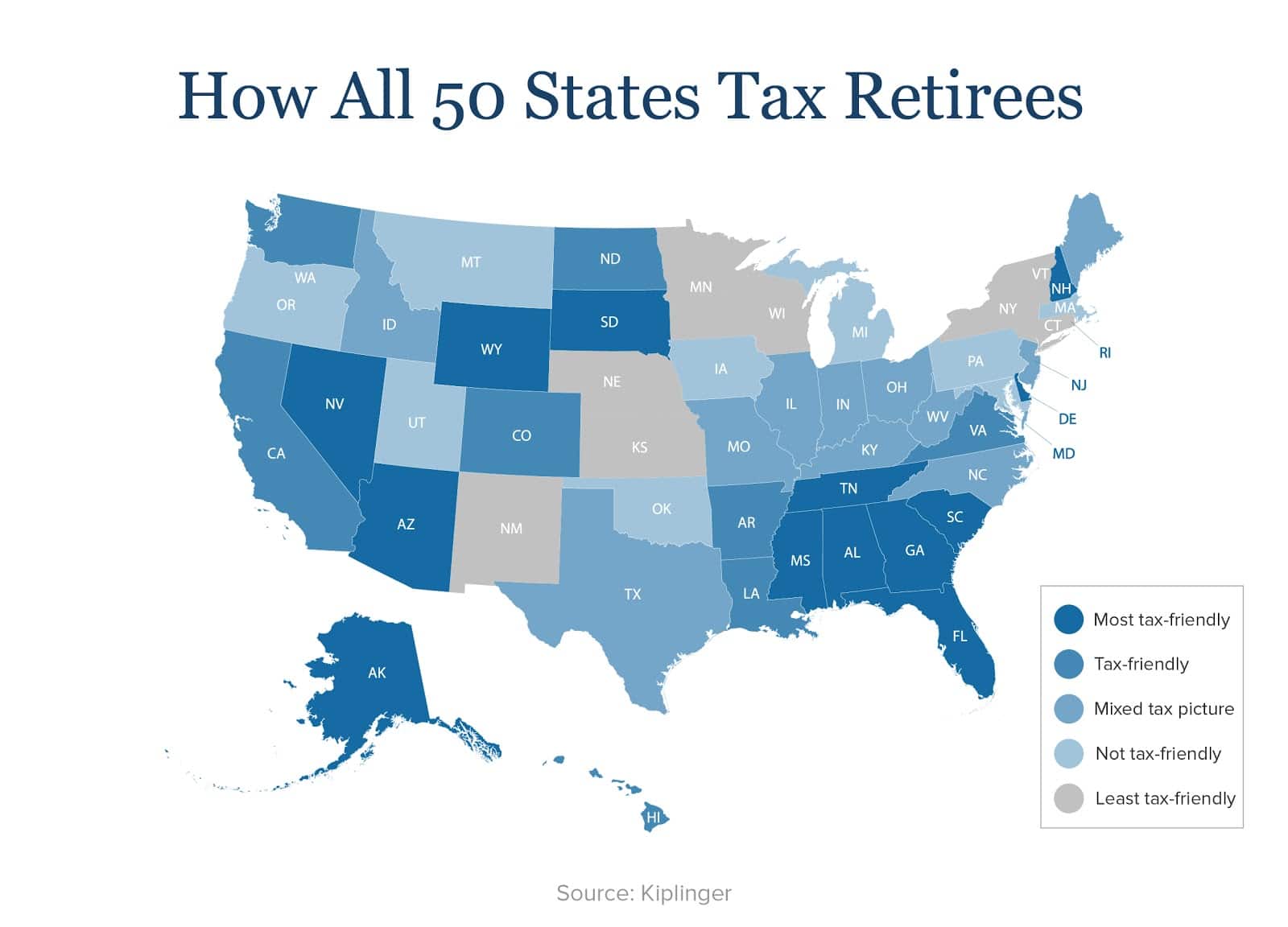

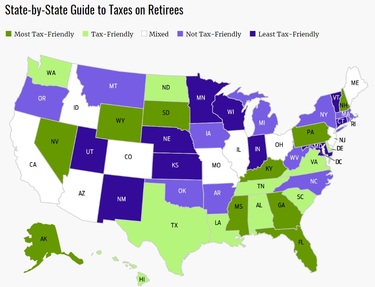

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Simply just multiply the property tax rate by the your assessed value 032782 district tax rate x 87500. Nevada corporations may issue stock for capital services personal property.

The housing market in Nevada was hard-hit in 2007. The state does not have estate or inheritance taxes either. 3 in its list of the most tax-friendly places to retire.

Lets pretend that the amount of your income taxable on a personal level is. 20000 for those ages 55 to 64.

How To Plan For Taxes In Retirement Goodlife Home Loans

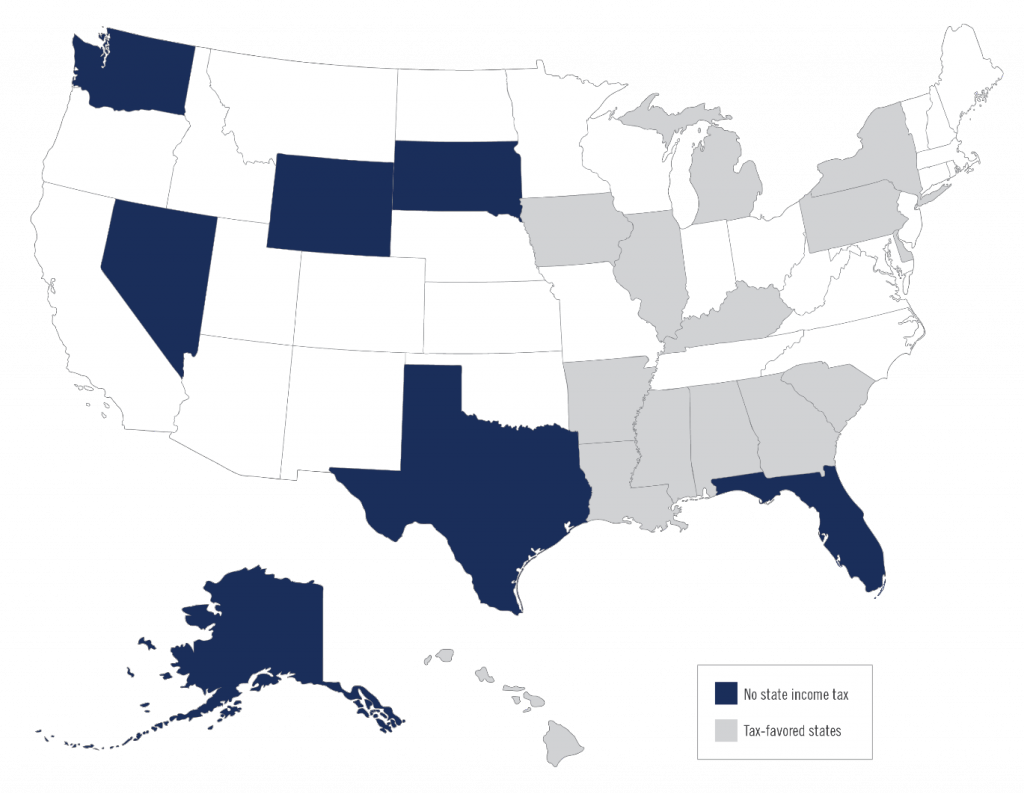

Retiring These States Won T Tax Your Distributions

It Is Up To Us To Set Up The Right Plan To Ensure We Live Comfortably During Retirement Here Are A Few Making A Budget Retirement Planner Retirement Planning

Relocating To A Tax Favorable State For Retirement Is It Worth It Cain Watters Blog

The Most Tax Friendly States For Retirees Vision Retirement

Retiree Tax Map Reveals Most Least Tax Friendly States For Retirees Senior Living Proaging News By Positive Aging Sourcebook

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

How To Plan For Taxes In Retirement Goodlife Home Loans

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

How To Plan For Taxes In Retirement Goodlife Home Loans

Retiring These States Won T Tax Your Distributions

Nevada Retirement Tax Friendliness Smartasset

Nevada Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

Nevada Tax Advantages And Benefits Retirebetternow Com

Taxation Of Social Security Benefits Mn House Research